1.What is DAICO? #daico #ico #smartcontract #blockchain #airdrop #bounty #marketplace #winbix #wbx

Proposed by one of the most brilliant faces of blockchain technology today is Vitalik Buterin, founder of Ethereum, DAICO can be seen as a model of modern decentralized capital investment.

Proposed by one of the most brilliant faces of blockchain technology today is Vitalik Buterin, founder of Ethereum, DAICO can be seen as a model of modern decentralized capital investment.

DAICO is a word association between the Decentralized Autonomous Organization (DAO) and the Initial Coin Offerings (ICO). DAICO helps to put in place more stringent management rules for ICO projects to avoid risks reimbursement of contributions if they are dissatisfied with the development for investors, through rigorous rules. DAiCO allows token holders to vote for process of the project development team.With DAICO projects, the developer team token owners to be more secured and guaranteed to be product of minimum profitability will be subject to a degree of responsibility to the investor and helps the or to be refunded.There are three main elements that DAICO derived from the

DAO:

- First, never put absolute trust in a centralized team.Capital contributions from the beginning were determined by the electoral

system.

- Secondly, capital accumulation is not spent in one time but by a mechanism of spending money gradually over time.

- And finally, the opportunity to refund the capital contribution. This decision is based on ‘crowd consent’, which means that investors may vote to withdraw the remaining funds if the project team fails

2. How does DAICO work?

The DAICO starts similarly to the ICO, which allows the project team call-up investors to send Ethereum to the ICO into DAICO and the investors still receive the project tokens as normal. After the expiry date of the ICO sale, the tokens can be traded. Nothing new at this point.

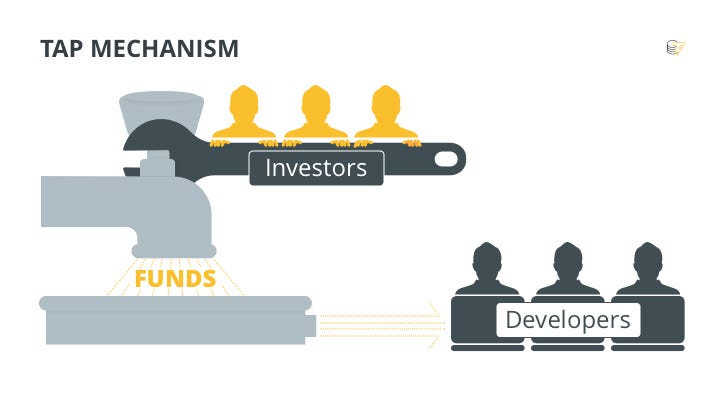

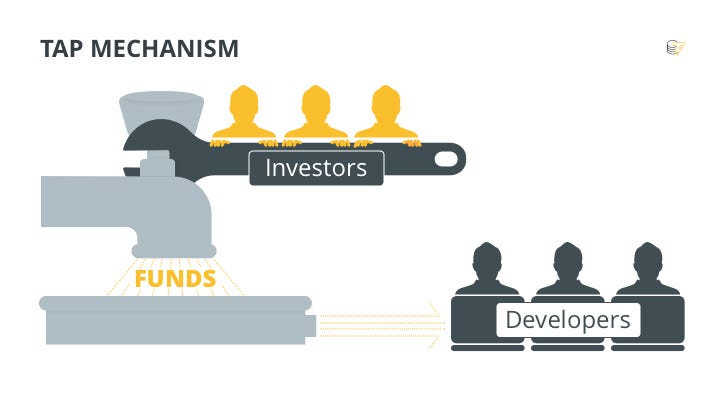

The difference that DAICO creates is in the sequel, after the calling phase, when a special mechanism, called TAP, is put into use. TAP allows the investors (who are holding the tokens of the project) to control the capital employed by the project team (financial control). In the current ICO money is used, can not control. But at DAICO, the amount is controlled, model, there is no such mechanism, so the project team wants to use how much TAPs.according to two conditions: the amount provided in each TAP and the number of If the project team wants more capital to recruit, expand…they must ask for TAP. Investors will vote and will or will not have a TAP

based on votes. This helps the DAICO investment community to manage their

investments and understand what their money is used by the investment group.

3.Distinctive features of the PreDAICO/DAICO WINBIX:

- The collected funds are stored in a smart contract and allocated to the team in parts.

Only Ethereum is accepted as payment for tokens. Ethereum is stored in a smart contract. The allocation of funds occurs once a month in the amount of TAP. The team may initiate a change of TAP no more than 1 time in 30 vote is necessary. Only tokens of buyers at the DAICO/PreDAICO can participate days. For this decision to be made, the consent of 50% of the voters plus 1 in the voting. Tokens which are allocated through marketing programs (Airdrop, Bounty) or purchased on the secondary market do not have the right to vote.-Reporting of the team to the investors The team publishes reports on the use of funds on the official website of the company: winbix.com Giving investors the right of sole exit from the project Any token (except the tokens which are received through marketing programs or purchased on the secondary market) can be returned to the

PreDAICO/DAICO smart contract (after 45 days since the end of the PreDAICO or

balance of funds for the moment

after 90 days since the end of the DAICO) with the receipt of a share of the

-The tokens are not allocated to the project team and the

advisers.

-Creation of a smart contract to back by a token WBX (unit

of backing is Ethereum) A smart contract “SECURITY” is created to be funded by the part of the marketplace commission fee 5 years. Any token (without any limitations) can be returned to the contract with the receipt of a share of funds for the moment.

-a reversed buyback at the fixed price in Ethereum through appropriate smart contract “BUYBACK”Within 6 years from the launch of the marketplace, WINBIX makes a reversed buyback of tokens at the fixed price. The purchase price is increased by 100% annually.

3.1 PreDAICO

Period: April 24, 2019 — June 22, 2019,,with the possibility of extension to 30 calendar days.

The total number of tokens emitted - 27 500 000 WBX, of which: 25 000 000 WBX – free sale, 2 500 000 WBX – marketing (10% of all the tokens sold). Untapped and unallocated tokens are destroyed. The tokens are not allocated to the project team.

The average selling price of tokens: 0,00065 ETH

HARDCAP - 25 000 000 WBX

SOFTCAP – 6 250 000 WBX

3.2 DAICO

It starts 12 months after the end of the PreDAICO procedure. At the time of the start of the DAICO procedure,all the owners who received their tokens during the PreDAICO (bought and got through marketing programs) and passed through the KYC procedure GET THE RIGHT to receive the additional tokens (+ 100%).

The total number of tokens emitted is 155 000 000 WBX, of which: 125 000 000 WBX – free sale, 2 500 000 WBX – marketing (2% of the tokens sold), 27 500 000 WBX – the additional tokens to the PREDAICO participants. Untapped and unallocated tokens are destroyed. The tokens are not allocated to the project team.The duration is 90 calendar days, with the possibility of extension to 30 calendar days.

Sale - 125 000 000 WBX, average selling price - ETH 0,0013

HARDCAP – 125 000 000 WBX

SOFTCAP – 31 250 000 WBX

-LINK WEBSITE :https://winbix.io

#daico #ico #smartcontract #blockchain #airdrop #bounty #marketplace #winbix #wbx

No comments:

Post a Comment